Investment in carbon capture has nearly doubled since last year to $6.4 billion.1 And it is forecasted to grow at least another six-fold by the end of the decade.2 Carbon emissions have become an increasing concern for governments around the world, targeted by new legislation every year. The Inflation Reduction Act is expected to turbo-charge the U.S. market, while governments in the U.K. and Japan have set 2030 targets. The source of carbon and how it’s captured varies as does the means of its capture, while innovation in modular systems and more efficient processes are bringing down costs in this growing asset class.

It’s been simmering, but the Intergovernmental Panel on Climate Change (IPCC) and governments around the world recognise the inevitability for active carbon management; namely: carbon capture use and storage (CCUS) and direct air carbon capture and storage (DACCS). The prominence given to carbon capture in IPCC reports is hotly debated by governments: Typically, governments with rich fossil-fuel reserves push for more, while others strive for a greater focus on renewables.

CCUS serves to decarbonise carbon-emitting processes, such as burning gas and biomass, or emitting industrial processes like making steel, cement and petrochemicals – avoiding emissions and storing it where economically viable and technically feasible (like existing underground caverns or injected back into oil wells). DACCS seeks to extract CO2 from the air – negative emissions.

Insurers should note that carbon capture, use and storage is not new. It has been around since the 1970s, mainly for gas processing (removing CO2 from the raw gas before marketing). Today, three quarters of captured CO2 is used for enhanced oil recovery – in this case it is CCU: carbon, capture and use.3

Today’s application is newer and the opportunity to use the carbon are slim relative to how much needs to be captured. The focus is on CCUS to decarbonise fossil fuelled power plants and industrial processes. In the short-term this will be driven by retrofitting carbon capture technology to existing facilities. Two of the options are post-combustion chemical absorption (using a solvent to absorb the CO2 from flue gas. It is then reheated to remove the CO2 and reuse the solvent) and oxyfuel combustion (burning fuel in a pure oxygen environment to produce easily divide CO2 and steam).4

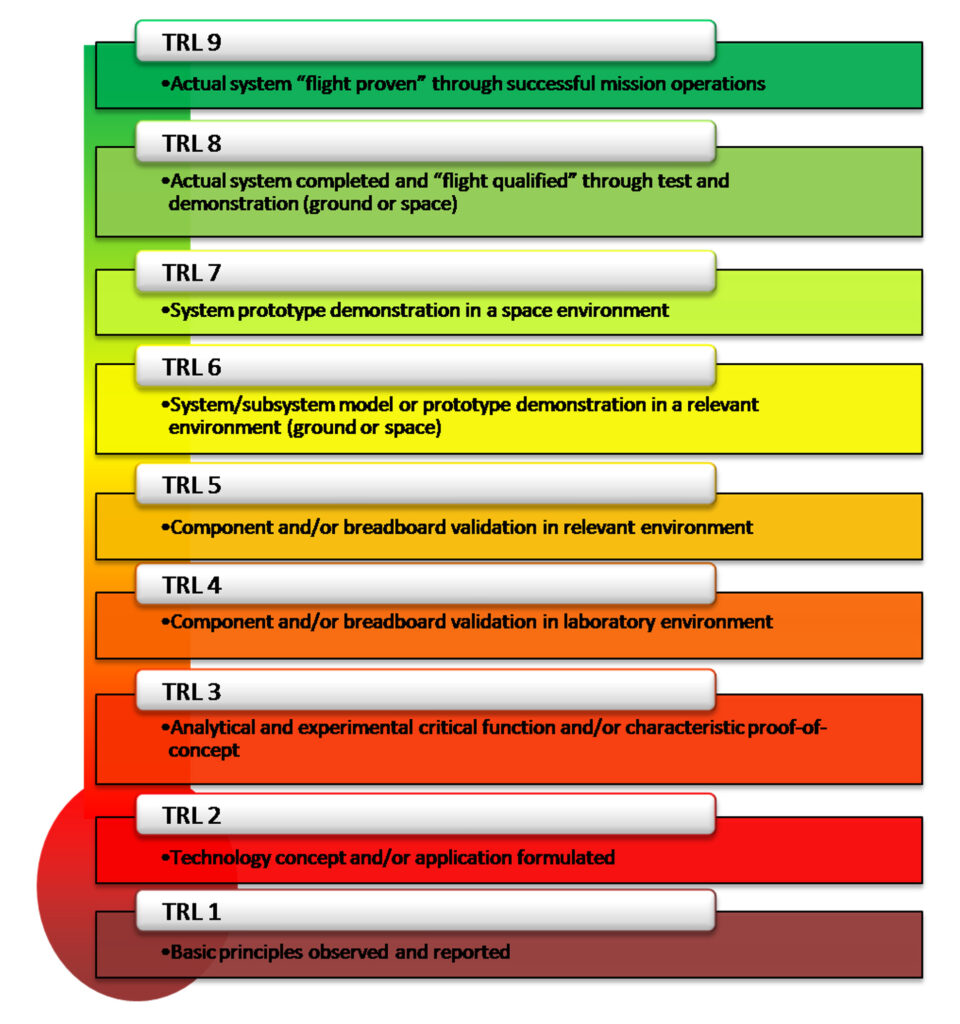

CCUS projects are expensive, require a lot of energy and lack a proven long-term operational reliability record. For example, the risk of leaks from CO2 stored underground. CCUS might even warrant a TRL (technology readiness level) of 8 given there are only around 50 CCUS projects, with a mixed track record (Figure 1).56 But, with over 500 projects under development, investors are confident it can work reliably. Some of this confidence is attributed to growing financial support for projects.

Figure 1: Technology Readiness Level

Image source: https://www.nasa.gov/sites/default/files/trl.png

Governments around the world are trying to incentivize investors to develop CCUS projects. In the U.S., CCUS projects are eligible for tax credits, where the inflation reduction act increased the value of the tax credits by 70%, from $50/mt to $85/mt.7 In its Spring 2023 budget the U.K. government allocated 20 billion pounds for the early deployment of CCUS. The U.K. also wants to develop CCUS clusters and capture 20-30 MtCO2 per year by 2030. Japan also has a 2030 capture target of 8-12 MtCO2 per year. To meet the target, Japan’s biggest oil refiners, utilities, and industrial companies have started joint ventures, joint studies and a plan to build a value chain.

DACCS serves a different purpose. It aims to remove CO2 from the atmosphere, yielding negative emissions. In theory it gives nations an opportunity to offset existing emissions on a route to net-zero, or to aggregate negative emissions, reversing some of the damage already done. The challenge is it is expensive. It requires a lot of energy given that CO2 is less concentrated in air than in flue gas. Nonetheless, demo projects are underway. Iceland is home to the world’s first large-scale DACCS plant. It is a modular design where the first project can remove 4,000 tonnes of CO2 a year, the next project is targeting 36,000 tonnes of CO2 a year.

Protecting the ‘E’ is critical but the ‘S’ in ESG also affects lives. Sudden closures of fossil fuel plants or mothballing old industrial processing plants in favour of newer, zero-carbon options (often in different locations) can have dire impacts on a community. Jobs are lost and it can ignite a deprivation cycle. CCUS is not perfect but it could plug this gap in the short-term while these plants age as planned, giving time for communities to adapt. The political leverage and implications cannot be ignored.

NARDAC has helped our clients take on new construction risks in the emerging Carbon Capture market, and along with our (re)insurers will continue to support clients as they transition to lower and eventually zero-carbon solutions. New technologies can be challenging to finance and insure but we are applying our experiences and lessons learnt from de-risking new technologies like solar, wind, offshore wind, floating wind, tidal stream and now batteries as they moved from the periphery to the mainstream.

- https://about.bnef.com/blog/carbon-capture-investment-hits-record-high-of-6-4-billion/

- https://www.iea.org/data-and-statistics/data-tools/ccus-projects-explorer

- https://ieefa.org/resources/carbon-capture-crux-lessons-learned

- https://www.lse.ac.uk/granthaminstitute/explainers/what-is-carbon-capture-and-storage-and-what-role-can-it-play-in-tackling-climate-change/#:~:text=Two%20of%20the%20main%20ways,a%20technological%20foundation%20with%20CCUS.

- https://www.nasa.gov/directorates/heo/scan/engineering/technology/technology_readiness_level/

- https://status22.globalccsinstitute.com/wp-content/uploads/2022/11/Global-Status-of-CCS-2022_Download.pdf

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/072523-ira-turbocharged-carbon-capture-tax-credit-but-challenges-persist-experts