Tom Harries investigates the dynamics and potential outcomes of the U.K.’s fourth CfD round.

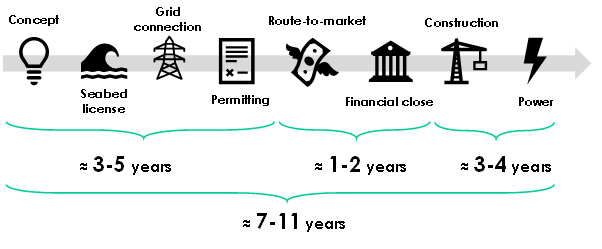

Offshore wind project development in the U.K. is a journey (Figure 1). From idea to full power can take 7-11 years. Securing a seabed license, a grid connection and permitting (or securing consent) are binary processes – you’re successful or you’re not. If successful, the only thing delaying construction is securing finance.

Offshore wind projects sell megawatt-hours and without a locked-in price for the product revenue is volatile and it is harder to raise finance at reasonable rates. A government contract, guaranteeing a price over a long period of time, solidifies future revenues and business cases. It makes raising finance easier and cheaper and leads the way to financial close and the start of construction. In the U.K., new government contracts are issued through the contract-for-difference scheme.

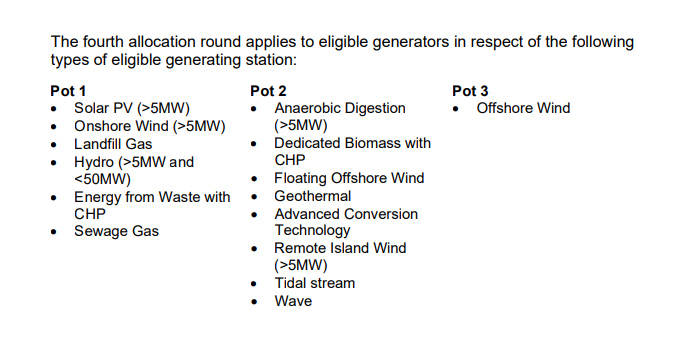

The fourth round of the U.K.’s contract-for-difference scheme, known as the CfD scheme, is underway. Its purpose is to provide a route-to-market for renewable projects, or, in other words, a contract guaranteeing a price per megawatt-hour generated by the project for 15 years. Put simply, the U.K. CfD scheme is an auction where developers bid at the lowest price per megawatt-hour it will accept for its production. It is a complex scheme. In this fourth round, there are three ‘pots’ of technologies, where technologies in each pot are bidding against each other for contracts (Figure 2). Offshore wind has its own separate pot.

Source: https://www.cfdallocationround.uk/publications/beis-cfd-ar4-allocation-round-notice

The number of megawatts that could receive contracts is a function of how low the bids are, which technologies are cheapest and various other assumptions for this round (mainly load factors and power price assumptions). The government then essentially calculates how far the 200 million pounds offshore wind budget can stretch. For example:

- If offshore wind bids clear at the bid cap (administrative strike price), the budget for round 4 could support around 2,800 megawatts of offshore wind.

- If offshore wind bids clear at the lowest price from round 3, it could support 5,400 megawatts

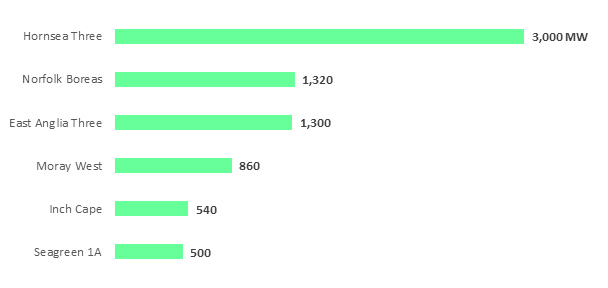

To be eligible to bid, offshore wind projects must have secured consent and hold a grid connection offer. At first glance, it appears 8,060 megawatts of offshore wind satisfy both criteria (Figure 3).

Source: Cross referencing capacity with a grid connection date within CfD round 4 delivery windows form the TEC register with consented projects from the National Infrastructure Planning database and the Marine Scotland planning database.

If offshore wind bids clear at only 6% lower than round 3, it could support all of the above estimated eligible capacity. (For context, the lowest bids in round 3 were around 30% lower than the lowest in round 2 – for offshore wind).

After the auction, successful bidders must adhere to the CfD milestones. It is these milestones that makes it easy to estimate the timing of the subsequent construction activity. Within 18 months of signing a CfD contract, a project must have committed to spent 10% of pre-commissioning costs (or an equivalent metric), which effectively means financial close, leading to construction. Winners of the current (fourth) CfD round will be announced by either May 23-24 or by July 8 at the latest (the range covers the eventuality of a dispute).1 Applying the milestone leads to financial close occurring by February 2024.

If all eligible capacity secures a contract, applying a capex multiple of 2 million pounds per megawatt yields an estimated capex spend of 16 billion pounds with an associated delay in start-up value of 1.7 billion pounds.

Summing the physical damage and business interruption leads to 18 billion of total insurable value that could be unlocked from the latest U.K. CfD round with the projects coming to the insurance market by February 2024.

This note focuses on the outcome for offshore wind but there is also an interesting dynamic for tidal stream projects, too. In the last auction, tidal stream projects had to compete against offshore wind projects. Unsurprisingly, tidal stream projects were unsuccessful given the relative scale and maturity of the offshore wind sector. This time, tidal stream is not only in a different technology pot but it has also been attributed a ‘minima’ of 20 million pounds; effectively ring fencing the money for only tidal stream projects.

It is the best chance a tidal stream project has had of securing a government contract for years. After reviewing the TEC register (transmission grid) and national planning infrastructure and marine Scotland databases, it suggests only one project has both grid capacity and planning consent: Meygen Phase 2. Cross-referencing the databases suggest there is up to 80MW of potentially eligible capacity (excluding any standalone demonstration turbines at shared grid facilities). Assuming tidal energy bids at around 150 pounds per megawatt-hour, leads to just over 50 megawatts with contracts. It equates to roughly 300 million pounds of total insurable value.