Rob Bates

Offshore renewable energy projects, and supporting infrastructure, will be critical to the success of the energy transition. The London insurance market plays a significant role in enabling this new infrastructure by underwriting through development and operation, globally.

But the paradigm shift in electrical power generation and transmission offshore is a complex process, and the journey to date has not been without its challenges. Chiefly, these have been experienced with cable failures, and multiple instances of serial defects in offshore turbines.

In supporting the shift to offshore renewables, NARDAC is often asked for its assessment of the London market’s appetite to insure these projects.

This year, we’ve formalised these requests into anonymised, published findings. We’re sharing this market survey here for the first time, and will set out on an annualised basis, in future.

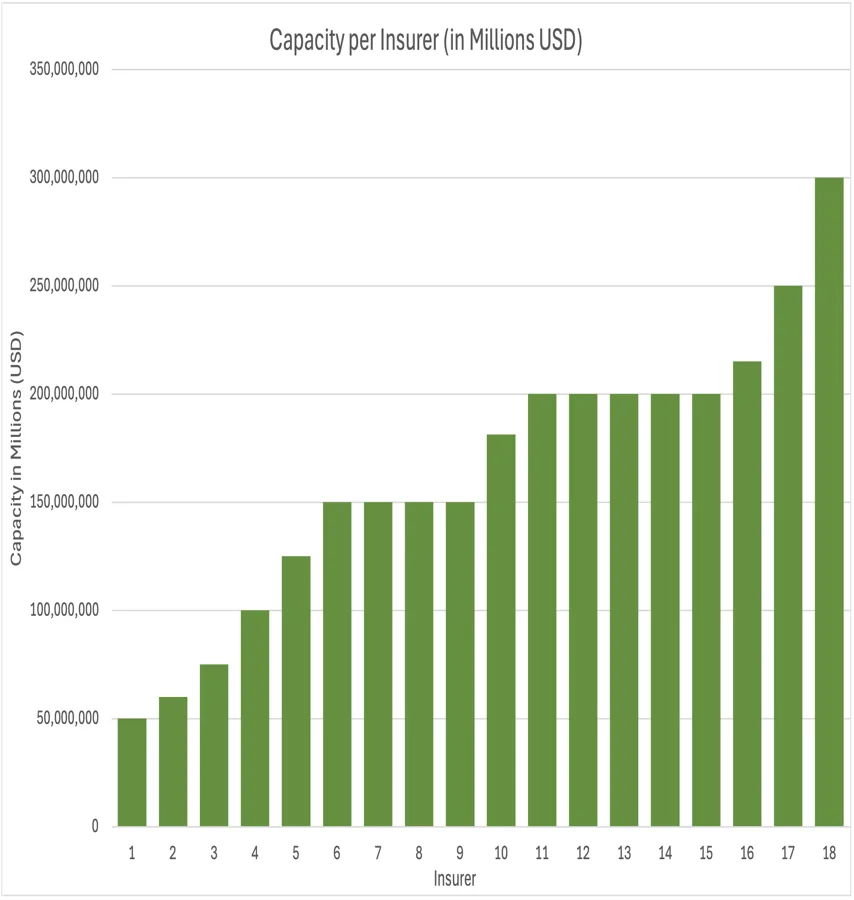

In our survey, we requested capacity provision from the 18 major insurers. We asked them to share the amount of underwriting capital they could offer for offshore technologies— including interconnectors, grid connections, fixed offshore wind, floating offshore wind, wave power devices, and tidal energy projects. The findings offer an encouraging picture of a robust market willing to deploy its significant capacity into supporting the energy transition.

Capacity Overview

Our survey demonstrates that for critical infrastructure like interconnectors and offshore grid connections there is capacity of nearly $3bn in the London Market alone. This suggests an overall solid foundation for large-scale projects, confidence in the underlying technology, and a recognition of the opportunity to secure favourable premiums. The mean capacity available per insurer stands at approximately $164m, closely aligned with a median figure of $165m, reflecting consistent deployment strategies among market participants. A notable modal average of $200m suggests several insurers within the market can handle significant portions of risk.

The variation in capacity, ranging from $50m to $300m, suggests that a broad risk appetite and healthy capability exists across the market and that project developers cannot ignore London market providers.

Line Sizes

The line sizes that lead insurers are willing to write remain substantial, ranging from 12.5% to 20% with a modal lead line of 15%. Notably, few insurers are offering small lines, with 50% exhibiting a desire to lead. This points towards a strongly competitive and likely softening market environment for insurers. These figures also indicate that despite recent challenges, such as cable failures, appetite remains robust, probably due to improved performance and terms compared to those available during the ‘soft market’ prior to 2019. Even though the maximum theoretical capacities range from £50m to £300m, actual deployment varies, particularly for newer technologies like wave & tidal. However, confidence in established technologies remains high demonstrated by the substantial capacity available for these classes of business.

Policy periods and flexibility

In addition, we found that insurers are confident in offering long-term coverage. All respondents could offer five-year construction policies with an additional two years of Maintenance and Defects (M&D) coverage. Several insurers indicated that policy periods could be extended, or special exceptions agreed, following referral to senior leadership and / or treaty reinsurer approval.

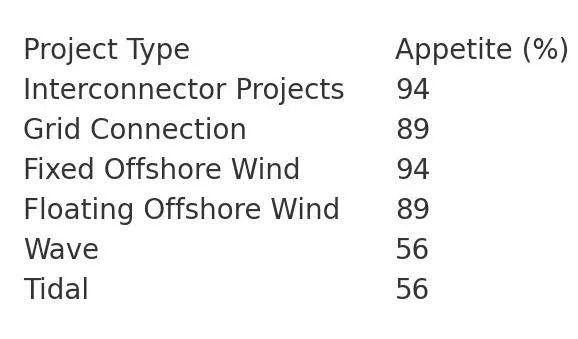

Risk appetite across technologies

Overall, the survey uncovered a broader and more robust appetite across the London Market than initially anticipated, with fixed infrastructure such as interconnectors and grid connections, gaining nearly universal interest from responders. Confidence in bottom fixed offshore wind was high with most insurers expressing support for these projects. Despite a more cautious approach from a few insurers, substantial interest for floating offshore wind projects also exists—with 89% of capacity providers indicating they would provide coverage. Across emerging technologies like wave and tidal energy, appetite is lower with 56% of insurers willing to support these projects. Although there is a higher perceived risk of these developing technologies, the fact that more than half of the respondents are willing to engage suggests that, at a certain level, the market is willing to carry pre-commercial risks.

Outlook

NARDAC’s survey reveals both a broad appetite and considerable capacity within the London Market for large offshore energy generation and transmission projects. Despite the challenges of previous years, particularly in the offshore wind sector, there are clear signs that the market is becoming increasingly confident in managing these risks and deploying significant capacity on a reliable, regular basis.

The results also show robust support for both established and emerging offshore energy technologies, demonstrating that insurers and their reinsurers are comfortable supporting newer designs. Feedback from the London Market displays its willingness and strategic commitment to supporting the next wave of renewable energy projects.

We’ll be formally working up our survey, which we’ll share publicly in due course, to support our insureds in working with the London market ahead of key renewals.