Tom Harries estimates the value and timing of when successful CfD projects will reach the insurance construction market

Earlier this month, the U.K. government awarded 10.8 gigawatts of CfD contracts across 99 renewable energy projects. A contract-for-difference (CfD) guarantees a price for the power generated by awarded projects for the first 15 years of operations. These CfD contracts make projects bankable and will spur a flurry of financing activity in the U.K. over the next 18 months.[1]

Each of the 99 projects awarded a CfD has met the first milestone of returning signed contracts to the Low Carbon Contracts Company.[2] The next major milestone date, ‘The Initial Milestone Delivery Date’ (IMDD), is critical for understanding the timing of when the 10.8 gigawatts will reach the insurance market.

In bidding for a CfD contract developers commit to commissioning within a given year. Most of the solar and onshore wind projects must be online by 2024/25 (financial year) whereas offshore wind and tidal projects have until 2026/27. Irrespective of the commissioning year, all projects share the same IMDD of 18 months after the Agreement Date.

By the IMDD, developers of winning projects must either spend 10% of pre-commissioning costs or prove a significant financial commitment to the project. In other words, projects must reach financial close by around the end of 2023. Before reaching a final investment decision, developers will need to have lined-up their insurance policies.

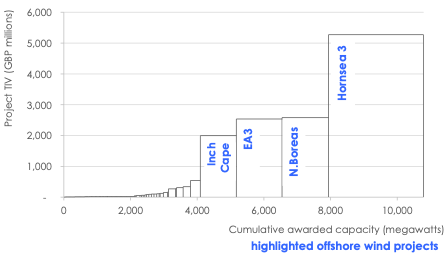

This latest CfD round (the fourth) should bring an estimated physical damage sum insured of at least 13.4 billion pounds to the insurance market. The associated revenue could bring another estimated 3.3 billion pounds in delay in start-up value. Combined, the total insurable value (TIV) could be as high as 16.7 billion pounds.

Four offshore wind projects (bottom-fixed) account for nearly three quarters of the estimated combined TIV (Figure 1). But, there is one other offshore project, Moray West. At 294 megawatts, it secured less capacity than the other four but in all likelihood the developer will probably build a bigger than 294 megawatt project given it has consent for an estimated 882 megawatts. The developer will likely blend its CfD contract with another power purchase agreement (PPA) and/or merchant exposure.

Figure 1: Awarded CfD project total insurable value ranked by project TIV

[1] For a primer on this U.K. CfD round, see: https://nardac.com/an-18-billion-pounds-wave-of-u-k-offshore-wind-construction/

[2] https://www.lowcarboncontracts.uk/news/announcement/all-ar4-contracts-set-to-proceed-in-most-ambitious-round-yet-of-uk-s-cfd-scheme